Bitcoin (BTC) has been trading inside a large range between $56,552 and $73,777 for several days. It is difficult to predict the direction of the breakout with certainty, because trading inside the range can be random and volatile. Hence, it is better to wait for the price to break out before establishing large bets.

Traders are becoming cautious in the short term due to the uncertainty. According to Farside Investors data, Bitcoin exchange-traded funds have witnessed outflows for the past four days. Additionally, CoinShares’ “Weekly Asset Fund Flows” report showed outflows of $600 million from digital asset investment products, the largest since March 22.

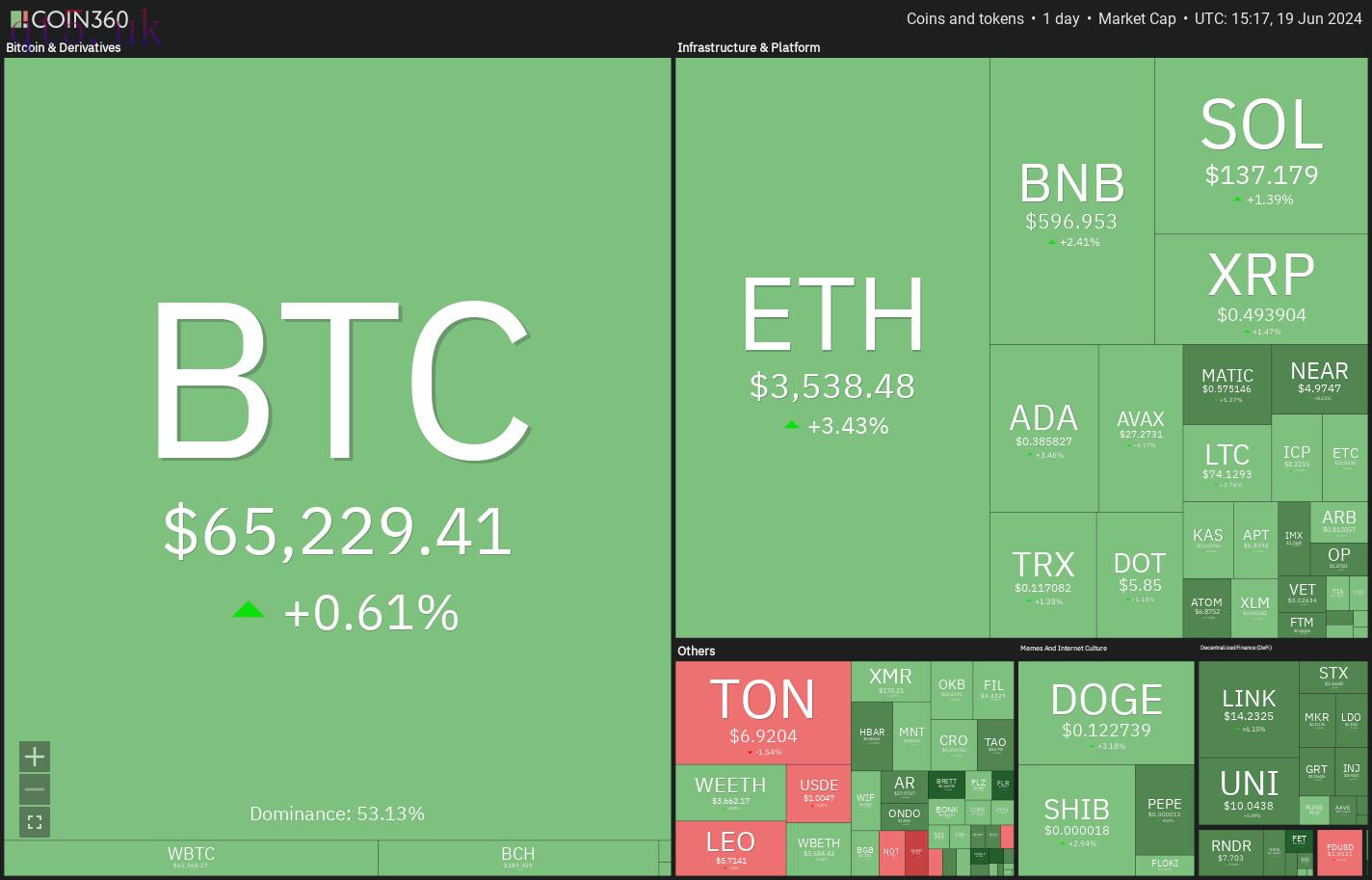

Crypto market data daily view. Source: Coin360

Crypto market data daily view. Source: Coin360However, Cointelegraph’s analysis of Deribit derivatives data shows that Bitcoin whales and market makers are not panicking and “remained optimistic during the dip.” Several analysts have also maintained a bullish view during Bitcoin’s drop below $65,000.

Will Bitcoin rebound off its strong support, pulling the altcoins higher? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin reached the bottom of its $64,602 to $72,000 range on June 18. The failure of the bulls to start a strong rebound off the level suggests that the bears are maintaining their selling pressure.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingViewThe downsloping 20-day exponential moving average ($67,249) and the relative strength index (RSI) below 40 indicate that the bears have the edge. If the $64,602 level cracks, the BTC/USDT pair could collapse to $60,000.

However, the bulls are unlikely to give up the $64,602 level without putting up a fight. If the price turns up from the current level and rises above the 20-day EMA, it will signal the start of a robust recovery. The pair may then climb to $70,000.

Ether price analysis

Ether (ETH) remains stuck between the moving averages, suggesting a sharp breakout could be around the corner.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingViewIf the price breaks above the 20-day EMA ($3,586), the ETH/USDT pair could rise to $3,730. This is an important level for the bears to defend because a break above it will open the doors for a potential rise to $3,977.

Conversely, if the price turns down and breaks below the 50-day simple moving average ($3,436), it will signal that the bears are in charge. The pair could tumble to psychological support at $3,000 and eventually to $2,850.

BNB price analysis

BNB (BNB) fell below the immediate support of $590 on June 18, but the bears could not challenge the vital support at $560. This suggests a lack of aggressive selling at lower levels.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingViewThe bulls are trying to start a recovery and push the price above the moving averages. If they manage to do that, the BNB/USDT pair could rally to $617. This is an important level to keep an eye on because a rise above it will suggest that the corrective phase may be over. The bulls will then try to push the price toward $722.

On the contrary, if the price turns down from the overhead resistance, the bears will attempt to sink the pair below $560. If they do that, the next stop is likely to be $536.

Solana price analysis

Solana (SOL) fell below the descending channel pattern on June 18, but the bulls purchased the dip, as seen from the long tail on the day’s candlestick.

SOL/USDT daily chart. Source: TradingView

SOL/USDT daily chart. Source: TradingViewThe downsloping 20-day EMA ($152) and the RSI is in the negative territory suggest that the bears are in command. If the price turns down from the current level or the 20-day EMA, the bears will try to tug the SOL/USDT pair to the critical support at $116. This level is expected to attract solid buying by the bulls.

This bearish view will be negated in the near term if the price turns up and rises above the resistance line. The pair may then climb to $176.

XRP price analysis

XRP (XRP) turned down from the 50-day SMA ($0.51) on June 17 but found support at $0.46 on June 18.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingViewThe 20-day EMA ($0.50) is flattening out, and the RSI is just below the midpoint, suggesting a minor advantage for the bears. The bulls will have to propel the price above the 50-day SMA to tilt the advantage in their favor.

On the other hand, a break and close below the $0.46 support will suggest that the bears have overpowered the bulls. The XRP/USDT pair could then skid to $0.41. The bulls are expected to fiercely defend the zone between $0.46 and $0.41.

Dogecoin price analysis

The bears pulled Dogecoin (DOGE) below the strong support at $0.12 but could not sustain the lower levels. This shows that the bulls are defending the $0.12 level with vigor.

DOGE/USDT daily chart. Source: TradingView

DOGE/USDT daily chart. Source: TradingViewBuyers will try to start a relief rally, but it is likely to face intense selling pressure at the 20-day EMA ($0.14). If the price turns down from the 20-day EMA, the bears will again strive to sink the DOGE/USDT pair below $0.12. If they succeed, the pair could start the next leg of the downtrend to $0.08.

Alternatively, a rally above the 20-day EMA will suggest that the pair may extend its stay inside the $0.12 to $0.18 range for some more time.

Toncoin price analysis

The bulls could not sustain Toncoin’s (TON) rebound off $7.67 on June 16, indicating a lack of demand at higher levels.

TON/USDT daily chart. Source: TradingView

TON/USDT daily chart. Source: TradingViewThe bears maintained their selling pressure and pulled the price below the 20-day EMA ($7.23) on June 18 and the uptrend line on June 19. The ascending triangle pattern will be negated if the price maintains below the uptrend line. That could start a decline to $6.

Conversely, if the price turns up sharply from the 50-day SMA ($6.67) and breaks above the uptrend line, it will signal that the breakdown may have been a bear trap. That could propel the TON/USDT pair to $7.67.

Related: Why is Ether (ETH) price up today?

Cardano price analysis

Cardano (ADA) signaled the resumption of the downtrend after the price plummeted and closed below the strong support at $0.40 on June 18.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingViewA minor positive is that the bulls purchased the dip to the $0.35 support. Buyers will attempt to start a recovery, which is expected to face strong selling at the moving averages. If the price turns down from the moving averages, the bears will try to sink the ADA/USDT pair below $0.35. If they can pull it off, the pair may slump to $0.28.

Contrarily, if buyers thrust the price above the moving averages, it will indicate that the corrective phase may be over.

Shiba Inu price analysis

Shiba Inu (SHIB) broke below the $0.000020 support on June 17, signaling that the bears are in control.

SHIB/USDT daily chart. Source: TradingView

SHIB/USDT daily chart. Source: TradingViewThe price slipped to the 78.2% Fibonacci retracement level of $0.000017 on June 18, where the buyers stepped in. The SHIB/USDT pair is attempting a rebound, which is likely to face aggressive selling at $0.000020. If the price turns down sharply from $0.000020, the bears will try to drag the pair to $0.000014.

This bearish view will be invalidated in the near term if the price turns up and rises above the moving averages. Such a move will suggest solid buying at lower levels.

Avalanche price analysis

Avalanche (AVAX) plunged and closed below the $29 support on June 17, signaling that the consolidation resolved in favor of the bears.

AVAX/USDT daily chart. Source: TradingView

AVAX/USDT daily chart. Source: TradingViewThe selling continued on June 18, and the price slipped to $25, where the buyers are trying to arrest the decline. The price could rise to the breakdown level of $29, which is likely to witness a tough battle between the bulls and the bears.

If the price turns down from $29, it will suggest that the bears have flipped the level into resistance. That increases the likelihood of a drop to $20.

If buyers want to make a comeback, they will have to drive the AVAX/USDT pair above the 20-day EMA ($31.71). If they do that, the bears may get trapped, resulting in a short squeeze.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website