An asset stuck in a trading range oscillates between the support and the resistance. Bitcoin (BTC) has been gradually sinking toward its support after failing to break out of the resistance. This suggests that the bears will attempt to yank Bitcoin below the range and seize control.

Bitcoin whales seem to have turned cautious after BTC slipped below its support near $64,500 on June 21. According to Santiment data, Bitcoin whales completed 9,923 transactions exceeding $100,000 during the two days on June 22 and 23. That is a sharp drop from the 17,091 transactions in the two days prior.

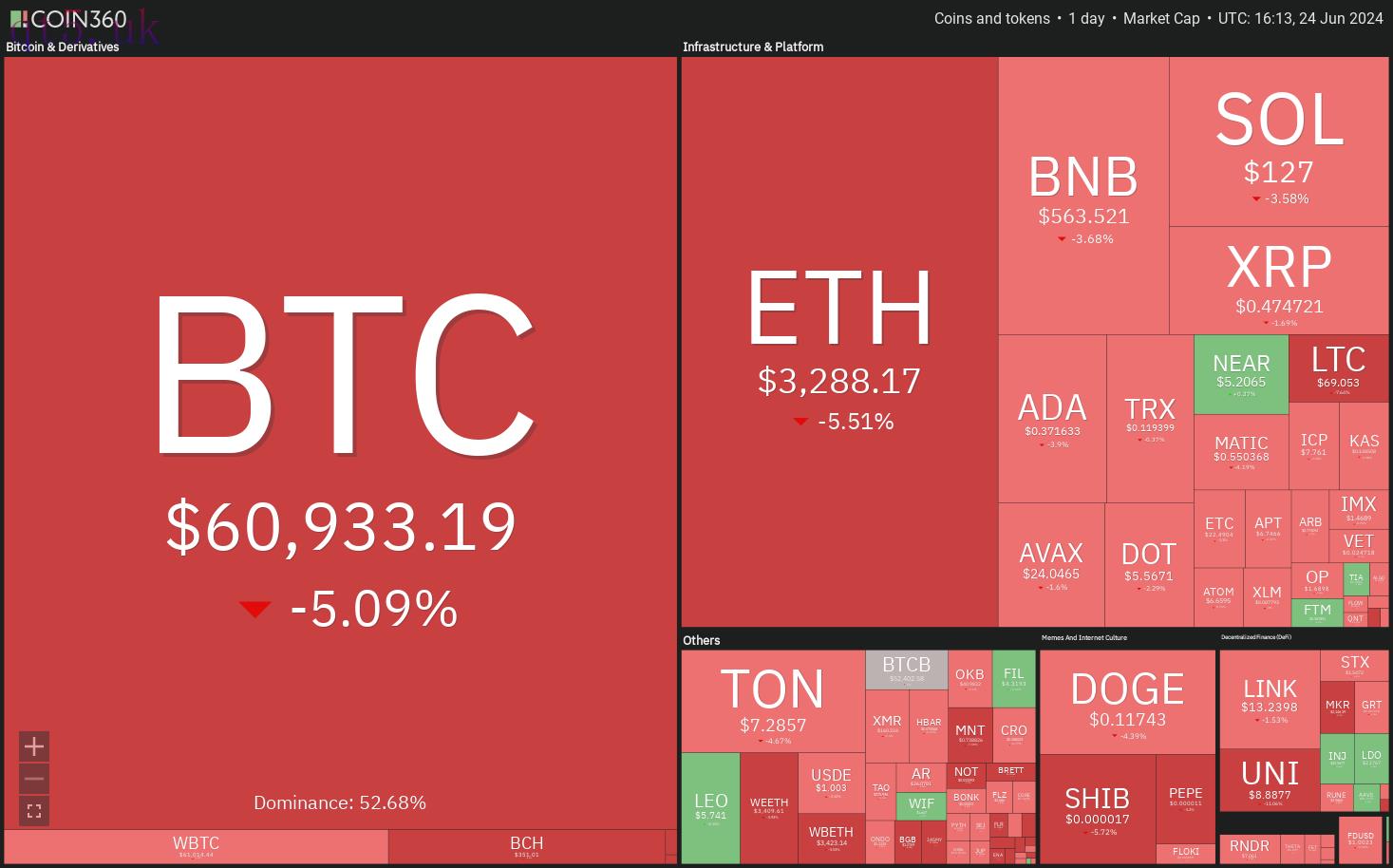

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360Bitcoin’s weakness may have kept the short-term traders on the hook, but the long-term investors are viewing the dip as a buying opportunity. Following in the footsteps of MicroStrategy, Tokyo-based investment and consulting firm Metaplanet revealed plans to issue one billion yen ($6.26 million) worth of bonds to raise money to buy Bitcoin.

Will Bitcoin plunge below the psychological support at $60,000, putting pressure on the altcoins? Let’s analyze the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index is in an uptrend. The bulls pushed the price above 5,500 on June 20, but higher levels witnessed profit booking.

SPX daily chart. Source: TradingView

SPX daily chart. Source: TradingViewDuring strong up moves, the corrections usually do not last more than three days. The 20-day exponential moving average (5,387) is the important level to watch out for on the downside. If the price turns up from the current level or the 20-day EMA, it will indicate that the bulls remain in control. A break above 5,505 could propel the index to 5,600 and eventually toward 6,000.

Time is running out for the bears. If they want to make a comeback, they will have to drag the price below the 20-day EMA. If they do that, the index could collapse to the 50-day simple moving average (5,237).

U.S. Dollar Index price analysis

The U.S. Dollar Index (DXY) bounced off the 50-day SMA (105.19) on June 20 and rose above the 105.74 overhead resistance on June 21.

DXY daily chart. Source: TradingView

DXY daily chart. Source: TradingViewHowever, the bulls are finding it difficult to sustain the breakout. The bears have pulled the price back below 105.74 on June 24. If buyers do not give up much ground from the current level, it will improve the prospects of a rise above 106. That could start a rally to 106.50 and later to the channel’s resistance line.

This optimistic view will be negated if the price continues lower and dives below the support line. The index may then descend to the strong support at 104, where buyers are likely to step in.

Bitcoin price analysis

Bitcoin turned down from the breakdown level of $64,602 on June 23, indicating that the bears are trying to flip the level into resistance.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingViewThe moving averages have completed a bearish crossover, and the RSI is in the oversold territory, signaling that the bears are firmly in the driver’s seat.

The BTC/USDT pair could plunge to solid support at $60,000. This level is expected to attract strong buying by the bulls, but any relief rally is likely to face selling at the 20-day EMA ($65,687). If the price turns down from the 20-day EMA, the possibility of a drop to $56,552 will increase.

The first sign of strength will be a break and close above the moving averages. If that happens, the pair could attempt a rally to $70,000 and subsequently to $72,000.

Ether price analysis

Ether’s (ETH) uncertainty resolved to the downside with a break below the 50-day SMA ($3,475) on June 23.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingViewThe downsloping 20-day EMA ($3,528) and the RSI near 35 suggest that the bears are in command. The sellers will attempt to sink the price to the psychological support at $3,000 and then to $2,850.

Buyers are expected to aggressively purchase in the $3,000 to $2,850 zone. On the upside, a break and close above the 20-day EMA will suggest that the bears are losing their grip. The ETH/USDT pair could then start an up move toward $3,730.

BNB price analysis

BNB (BNB) has continued to slide toward the immediate support at $560, indicating that the bears are maintaining their selling pressure.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingViewIf the price rebounds off $560 with strength, it will signal that the bulls are trying to defend the level. The BNB/USDT pair may recover to the 20-day EMA ($602), which is likely to act as a strong hurdle. If the price turns down from the 20-day EMA, it will increase the likelihood of a break below $560. The pair may then slump toward $536.

Buyers will have to kick the price above the moving averages to suggest that the selling pressure is weakening. The bullish momentum could pick up on a break and close above $635.

Solana price analysis

The bulls could not push Solana (SOL) back into the descending channel pattern in the past few days, indicating that the bears flipped the support line into resistance.

SOL/USDT daily chart. Source: TradingView

SOL/USDT daily chart. Source: TradingViewThe bears increased their selling pressure on June 23 and are trying to sink the SOL/USDT pair to the critical support at $116. This level is likely to attract solid buying by the bulls, but the recovery is expected to face stiff resistance at the 20-day EMA ($144).

If the price turns down from the 20-day EMA, the bears will make another attempt to yank the price below $116. If they succeed, the pair could slump to $100. On the upside, buyers will have to drive the price above the 50-day SMA ($156) to clear the path for a rally to $189.

XRP price analysis

XRP (XRP) has been oscillating between the critical support at $0.46 and the 50-day SMA ($0.51) for several days.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingViewThe downsloping 20-day EMA ($0.49) and the RSI in the negative territory suggest that the bears have the upper hand. If the $0.46 support cracks, the XRP/USDT pair could plunge to the next significant support at $0.41. Buyers are expected to aggressively defend the zone between $0.41 and $0.46.

On the upside, a break and close above the 50-day SMA will be the first sign of strength. The pair may then attempt a rally to $0.57.

Related: How low can the Bitcoin price go?

Toncoin price analysis

Toncoin (TON) turned down from the overhead resistance of $7.67 on June 24, indicating that the bears are fiercely defending the level.

TON/USDT daily chart. Source: TradingView

TON/USDT daily chart. Source: TradingViewThe $6.60 support is an important level to watch out for on the downside because a break and close below it will complete a bearish head-and-shoulders pattern. That could start a decline to $6 and subsequently to $5.50. The pattern target of the bearish setup is $4.91.

If the price bounces off the 50-day SMA, it will signal that the bulls continue to buy on dips. That could keep the TON/USDT pair stuck between the 50-day SMA and $7.67 for some time. A break and close above $7.67 will open the gates for a retest of $8.29.

Dogecoin price analysis

The failure of the bulls to start a strong rebound off the $0.12 support in Dogecoin (DOGE) has encouraged the bears to increase the selling pressure.

DOGE/USDT daily chart. Source: TradingView

DOGE/USDT daily chart. Source: TradingViewIf the price sustains below $0.12, it will indicate that the bears have overpowered the bulls. That could start a slide to psychological support at $0.10. The bulls will try to arrest the decline at this level, but if the bears prevail, the next stop could be $0.08.

This negative view will be invalidated in the near term if the price turns up from the current level and breaks above the 20-day EMA ($0.13). That could start a rally to the 50-day SMA ($0.15), keeping the DOGE/USDT pair stuck inside the $0.12 to $0.18 range.

Cardano price analysis

Cardano (ADA) is forming a range between $0.35 and $0.40, indicating buying at lower levels and selling on rallies.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingViewThe downsloping 20-day EMA ($0.41) and the RSI near the oversold territory signal that the bears are in command. If the $0.35 level breaks down, the selling could pick up, and the ADA/USDT pair may plummet to $0.30.

If bulls want to prevent the downside, they will have to push the price above the moving averages. If they do that, it will indicate that the markets have rejected the breakdown. The pair may then climb to $0.49.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website