The cryptocurrency market is up today, with the total market capitalization rising by approximately 0.8% in the last 24 hours to reach $2.28 trillion on June 27. That includes gains from top-ranking coins Bitcoin (BTC) and Ether (ETH), which have risen around 0.5% and 2.6% on the same day.

Crypto market performance June 27. Source: Coin360

Crypto market performance June 27. Source: Coin360Major catalysts driving the crypto market upward today include the ongoing inflows into the U.S. spot Bitcoin exchange-traded funds (ETFs) and a strengthening market structure.

Investors return to spot Bitcoin ETFs

The crypto market's ongoing gains align with the resumption of inflows into the U.S.-based spot Bitcoin ETFs. As of June 26, these funds were managing around $52.61 billion worth of BTC, up from $47 billion at the beginning of May.

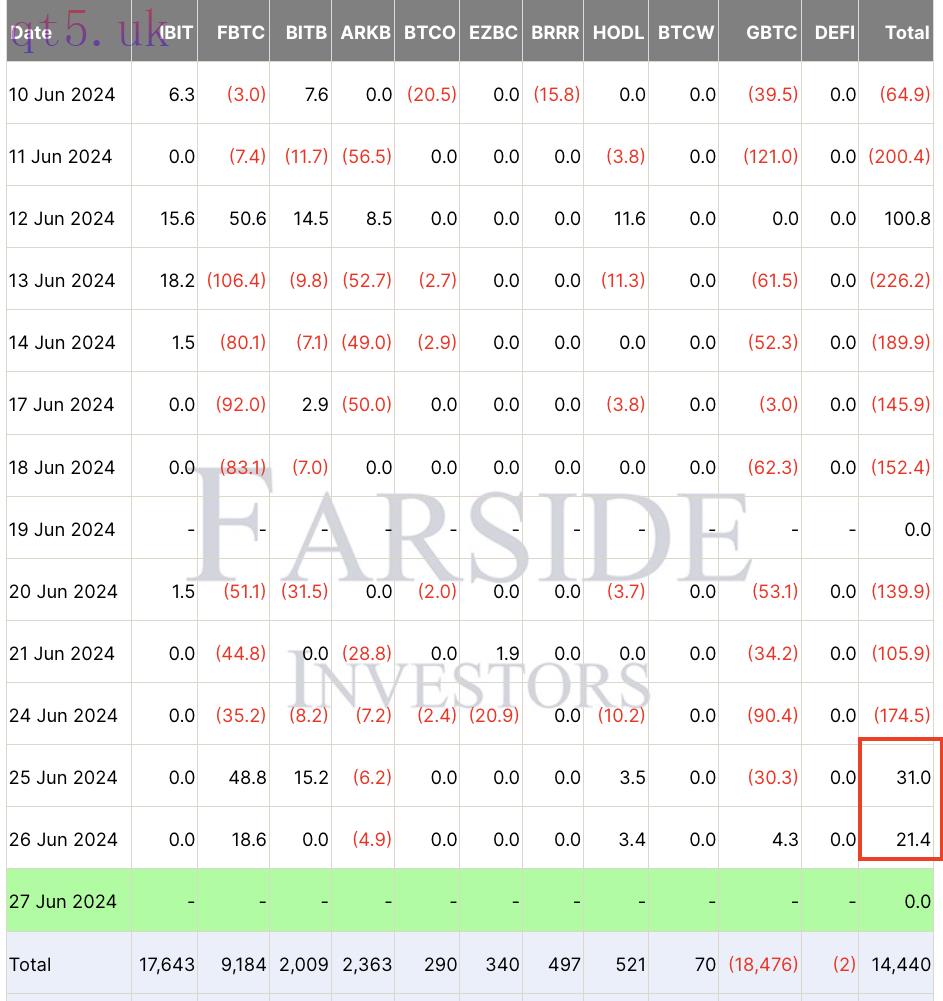

Data from Farside Investors reveals that after seven days of back-to-back outflows from these investment products, the spot Bitcoin ETF capital flows turned positive over the past two days, recording net inflows of $31 million and $21.3 million on June 25 and June 26, respectively.

Spot Bitcoin ETF flows table. Source: Farside Investors

Spot Bitcoin ETF flows table. Source: Farside InvestorsMeanwhile, VanEck, one of the first issuers of spot Bitcoin ETFs in the United States, has filed for a new Solana ETF.

VanEck, which also filed the first Ethereum ETF in 2021, may signal a broader trend as the recent approval of spot Bitcoin and Ethereum ETFs potentially paves the way for more crypto ETFs in the U.S.

This development highlights the growing acceptance and adoption of Bitcoin and other cryptocurrencies in the traditional financial sector, helping the crypto market's valuation rise today.

Higher Real GDP print boosts risk appetite

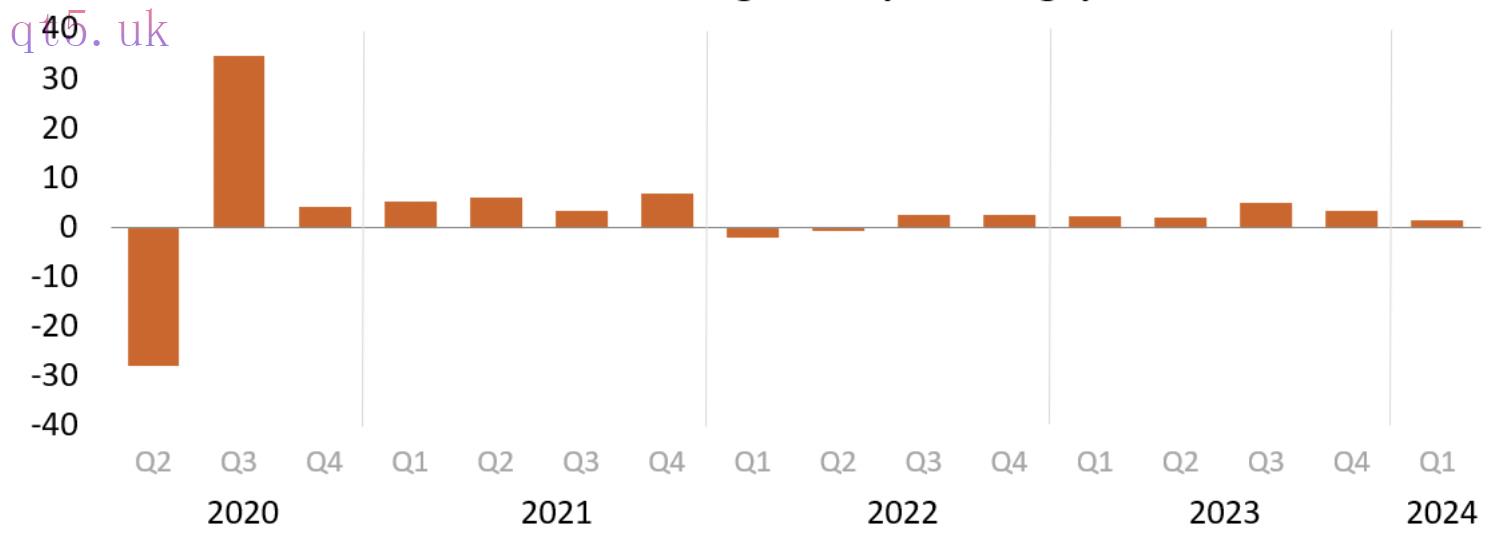

Markets opened to improving sentiment after the U.S. Q1 gross domestic product (GDP) came in slightly higher than expected at 1.4%. According to a report released by the Bureau of Economic Analysis on June 27, this is the slowest quarterly growth since spring 2022. In the fourth quarter of 2023, real GDP increased 3.4 percent.

The U.S. Commerce Department had previously estimated that the GDP— the economy’s total output of goods and services — would increase at a rate of 1.3% between January and March.

Percentage change in real GDP from the preceding quarter. Source: Bureau of Economic Analysis

Percentage change in real GDP from the preceding quarter. Source: Bureau of Economic AnalysisAt the same time, consumer spending decelerated more than anticipated, and the focus remains on the possibility of the Federal Reserve cutting interest rates to tame inflation.

The U.S. economy has proved resilient in the face of higher interest rates. The Federal Reserve raised its benchmark rate 11 times in 2022 and 2023 to a 23-year high to try to tame the worst levels of inflation in 40 years.

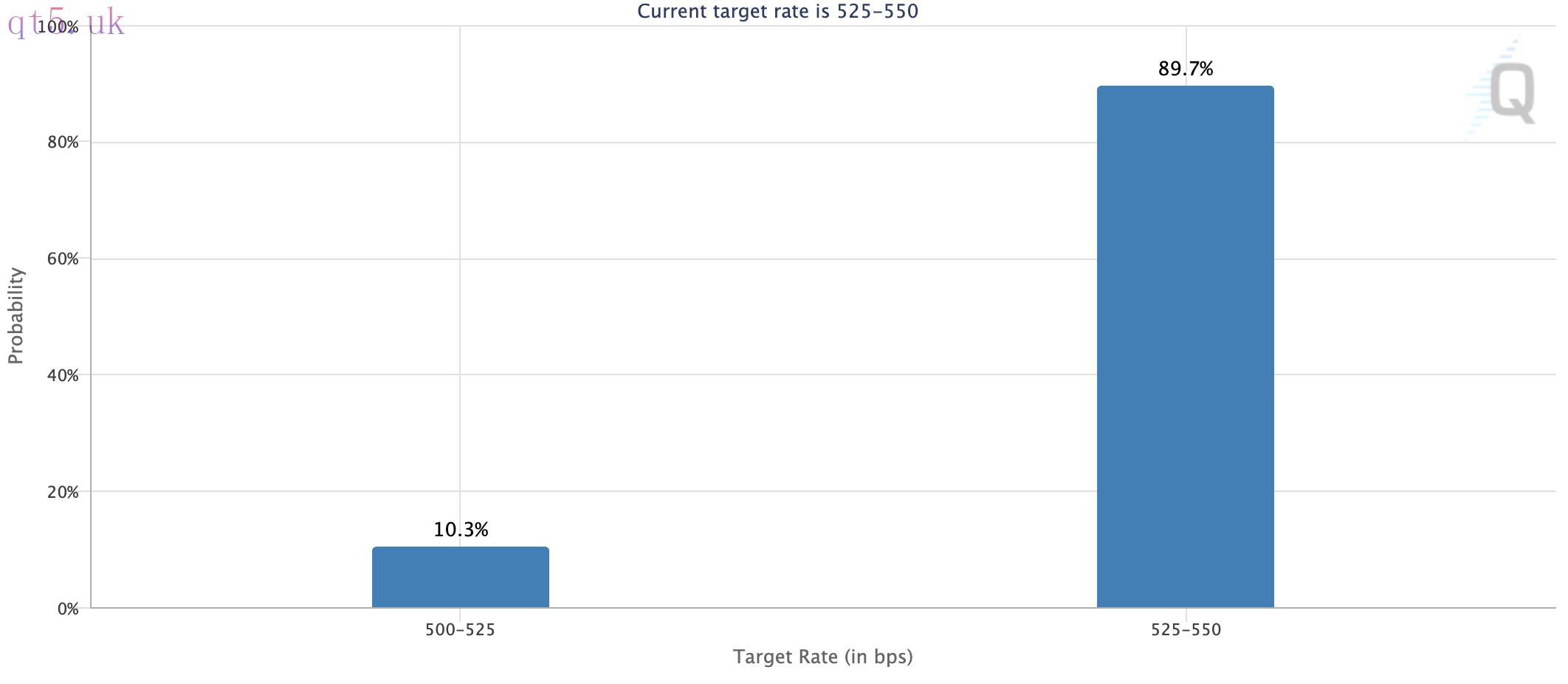

Most economists who had predicted approximately four interest cuts in 2024 are no longer fully pricing in an interest rate cut earlier than September.

The latest data from CME Group’s FedWatch Tool showed just a 10.3% chance of a cut at the Federal Open Market Committee's (FOMC) next meeting on July 31.

Fed target rate probabilities. Source: CME Group

Fed target rate probabilities. Source: CME GroupRelated: Bitcoin trader hopes for liquidity snatch as BTC price returns to $62K

The crypto market sees a technical rebound

From a technical perspective, the crypto market's gains today are part of a rebound that started at a support confluence comprising the major support at $2.172 trillion and the middle boundary of a descending parallel channel.

TOTAL crypto market capitalization daily performance chart. Source: TradingView

TOTAL crypto market capitalization daily performance chart. Source: TradingViewThe total market cap, at $2.23 trillion, broke above the upper boundary of the channel during the June 27 recovery, signaling a breakout from the downtrend.

As a rule of this technical formation, the crypto market could rise toward the $2.56 trillion area, embraced by the upper tip of the declining channel.

Before achieving this, the total market cap has to overcome supplier congestion between $2.30 trillion and $2.35 trillion, where all the major EMAs lie.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

download

download download

download website

website