GBP/USD: Pound falls - Trading analysis and commentary

GBP/USD: Sterling falls

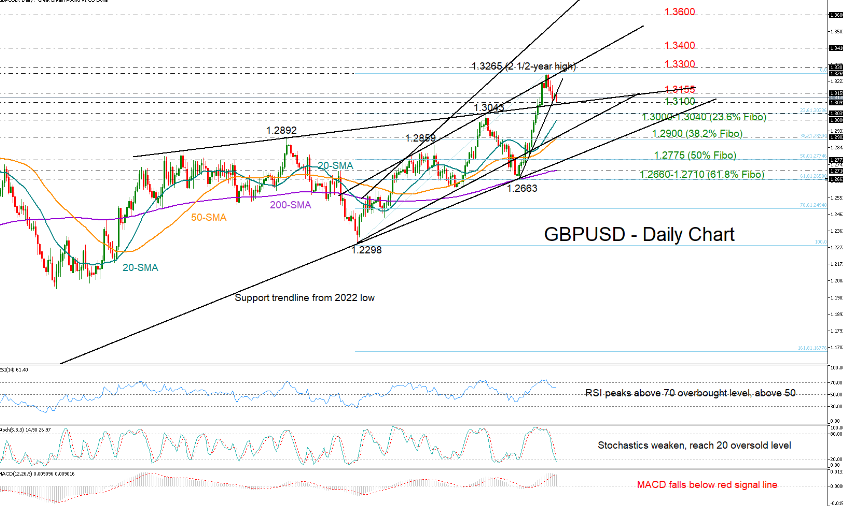

GBP/USD resumed its decline in early European trading on Tuesday, breaking below the steep support trendline that has restrained the decline from the 2-and-a-half-year high of 1.3265 over the past two sessions. This reflects more willingness to sell.

If the price falls below 1.3100, it may trigger more selling, targeting the 23.6% Fibonacci retracement of the April-July rally at 1.3040 and the 20-day simple moving average at 1.3000. If the bears dominate there, the negative cycle may extend to the 38.2% Fibonacci mark of 1.2900 and the 50-day moving average. Another step lower may confirm the continuation of the upward trendline since 2022, which is located near the 50% Fibonacci level and the 1.2775 level.

Technical indicators reflect that selling interest may remain unchanged in the short term for the time being. However, the rising slope of the moving averages means that the ongoing bearish wave may be part of a larger bullish trend.

If the price can recover above the broken support trendline at 1.3155, bulls will have another battle near the 1.3265 peak and strong resistance line from April. The 1.3300 figure will also be closely watched and if buyers break through this barrier, the rally may accelerate until the 1.3400 level. Above this, there are no major obstacles until the 1.3600 level.

Overall, GBP/USD is likely to face continued downward pressure in the coming sessions. For the bullish continuation, the price must surpass the resistance trendline at 1.3265.

- AI-CrypTo platform provides you with the safest, most stable and most profitable cryptocurrency automatic quantitative trading system! With a minimum deposit of 10 USDT, you can activate your investment account and enjoy stable returns and flexible withdrawals! 💵

- Each model has a different rate of return, choose a higher level of investment to earn more! AI quantitative returns range from VIP1 to VIP11, with daily returns as high as 40.9%! The more you invest, the greater the return! 💸

download

download download

download website

website