German inflation slowed more than expected, and eurozone inflation may fall further to 2.0%

Based on the given information, we can summarize as follows:

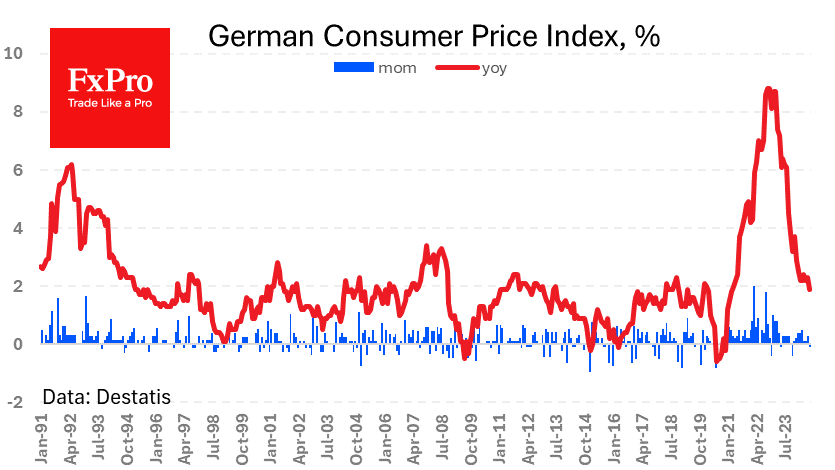

1. German inflation slowed more than expected, with the consumer price index falling 0.1% in August and the annual inflation rate slowing to 2.1%. This indicates that the German economy is weakening.

2. This data will have an impact on the Eurozone CPI forecast released on Friday, and the Eurozone inflation rate is expected to slow further to around 2.0%.

3. Influenced by this news, the euro fell against the US dollar to around 1.1070. This reflects concerns about the outlook for the European economy.

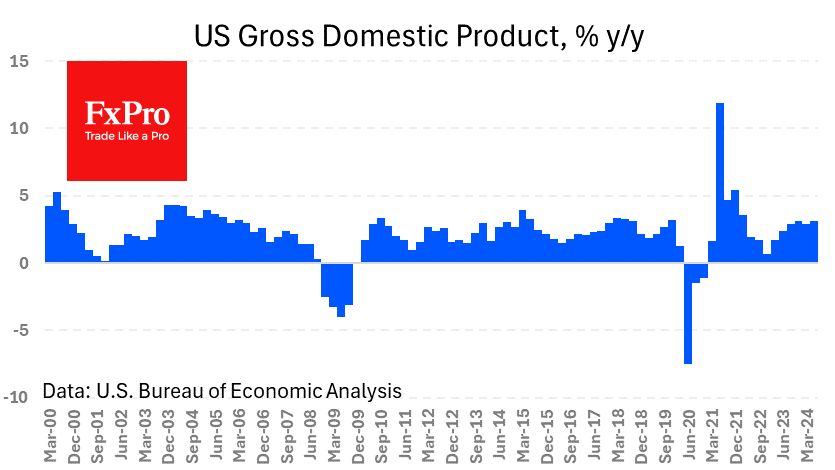

4. At the same time, US economic data performed strongly, with the GDP growth forecast for the second quarter raised to 3.0%, and the employment market data also exceeded expectations.

5. This may reduce market expectations that the Federal Reserve will significantly cut the federal funds rate in September, and the US dollar may be supported. However, the market expectations for interest rate cuts are still high.

Overall, the unexpected slowdown in German inflation highlights the weakness of the European economy, which puts downward pressure on the euro, while the relatively strong US economy will support the US dollar.

- AI-CrypTo platform provides you with the safest, most stable and most profitable cryptocurrency automatic quantitative trading system! With a minimum deposit of 10 USDT, you can activate your investment account and enjoy stable returns and flexible withdrawals! 💵

- Each model has a different rate of return, choose a higher level of investment to earn more! AI quantitative returns range from VIP1 to VIP11, with daily returns as high as 40.9%! The more you invest, the greater the return! 💸

download

download download

download website

website