Highlights:

- Zeus Network plans to connect Solana to Bitcoin with a cross-chain bridge that will enable BTC holders direct access to the Solana DeFi ecosystem.

- EigenLayer will distribute 5% of the total token supply to stakers on May 10, along with an additional 1.68% of the total supply to over 280,000 wallets. However, the tokens are not transferable at the token generation event (TGE). Season 1 claimants receive at least 110 EIGEN, while Season 2 participants get a minimum of 100 EIGEN. The tokens are currently priced at $8.8.

- Charles Hoskinson hinted at a potential collaboration between Cardano and Bitcoin Cash, asking the community if they would back such an integration in an X poll. Out of 12,000 votes cast, 66.3% showed support for the idea.

Forecast

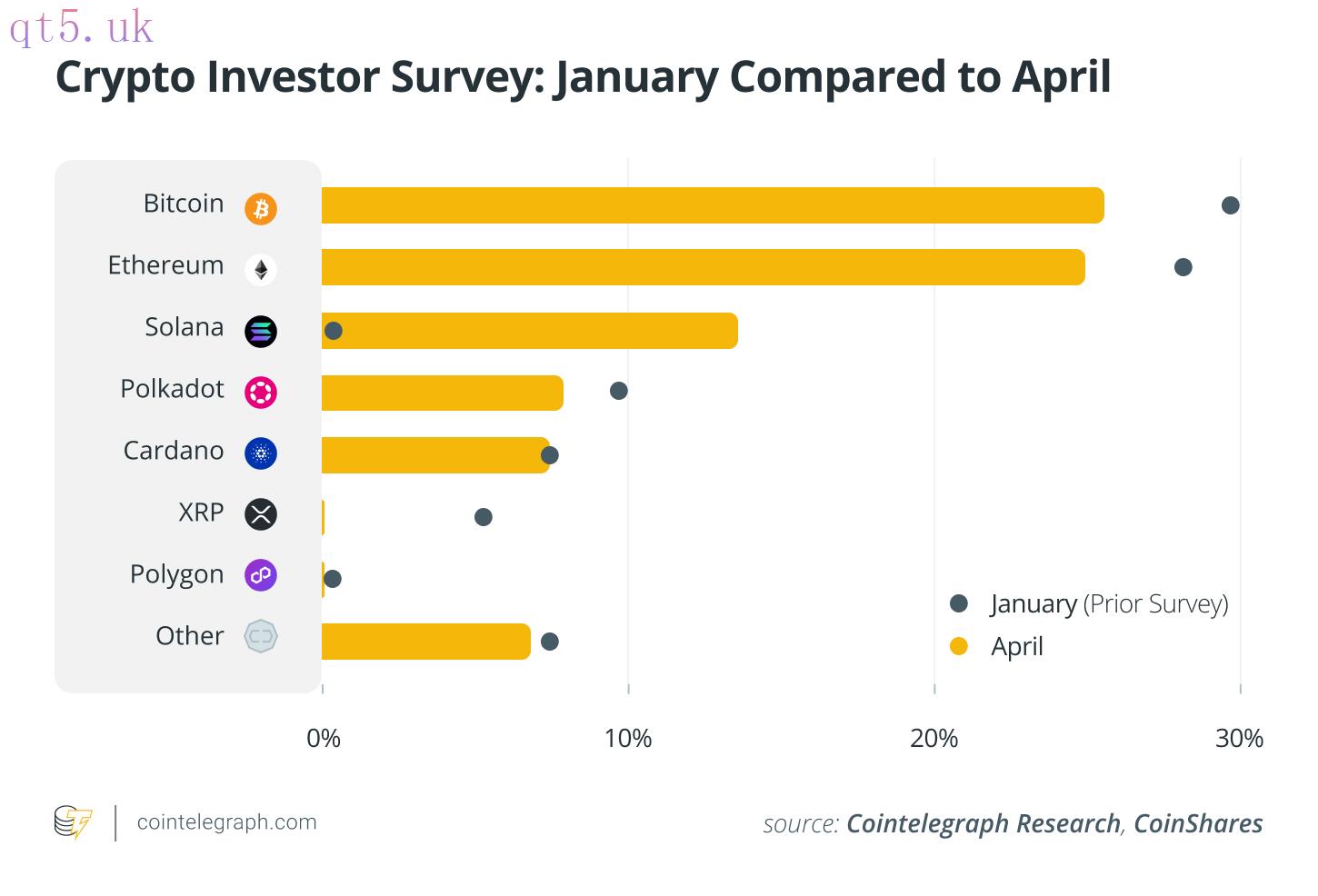

Under the current macroeconomic conditions, Bitcoin dominance will remain relatively high, which is unfavorable for inflows into the altcoin market. However, in the recent past, Solana has managed to surprise with its performance despite this backdrop. Its ecosystem’s growth is attracting institutional interest, evidenced by a 14% rise in institutional investment this year, and its capital inflows remain positive.

Sentiment

The altcoin season indicator hit 23 in mid-April, the lowest level since December 2023. This suggests that Bitcoin has outperformed over 75% of the altcoins in the last 90 days. Nevertheless, altcoins such as Solana, backed by solid fundamentals, might be poised for a strong rebound. The launch of a Solana Spot exchange-traded fund (ETF) in Canada could attract more institutional investors and retail traders, significantly increasing trading volume and liquidity for the Solana ecosystem.

Analysis

Alongside a 16% price decline for Bitcoin in April, the altcoin market cap has dropped 22.96% from $1.15 T to $887.62 B. There has since been a 1.53% rebound as of May 9, but two key indicators continue to paint a negative overall picture. Firstly, the long-term uptrend in Bitcoin dominance, which has increased by 32% over the past two years, continues to exert pressure on altcoin liquidity and growth as capital remains concentrated in Bitcoin. Secondly, the altcoin season index briefly dropped to the “Bitcoin Season” level in mid-April, meaning Bitcoin still outperformed 60% of altcoins over a 90-day period.

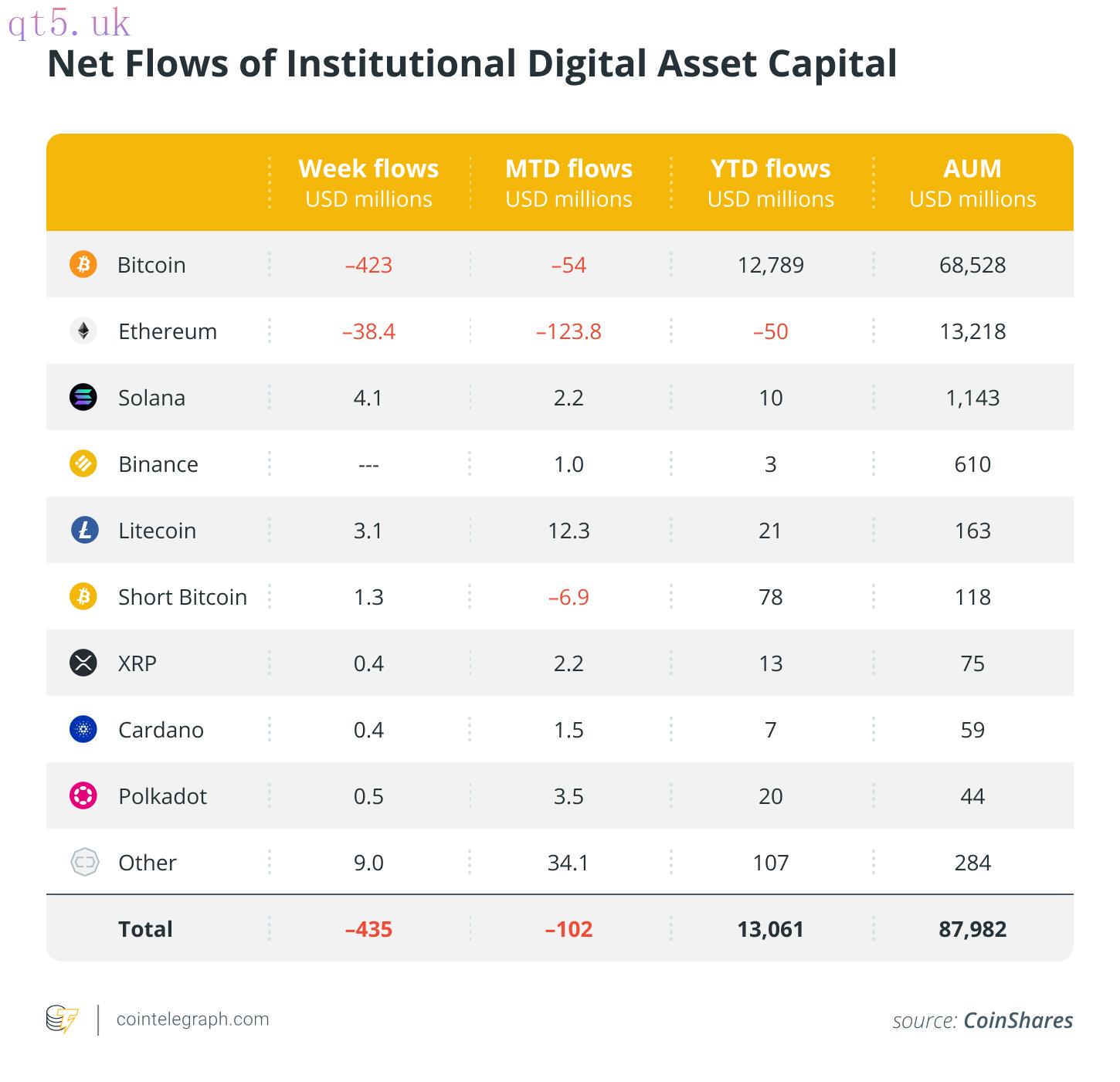

Most altcoins saw a rebound in early May. Solana stood out with a 23% Month-to-Date performance among the top 5 assets by market cap, surpassing ETH by over 20%. The growing interest in Solana is possibly driven by increased capital inflow and ecosystem activities. According to CoinShares statistics for the week ending on April 26th, Solana experienced a net positive inflow of $4.1 M in the weekly and $2.2 M in the monthly periods, contrasting with Ethereum, which witnessed net outflows of -$38.4 M and -$123.8 M respectively. A survey of 64 investors managing a total of $600 B in assets also revealed that since January 2024, approximately nine institutional investors have transitioned from having no investments to now holding Solana.

With over 24 M daily active transactions, Solana has also become the fourth-largest decentralized finance (DeFi) chain and is thus starting to seriously compete with Ethereum. On the 21st of April, it momentarily claimed the leading position for the daily decentralized exchange trading volume from Ethereum, fetching $1.4 B. This rising DeFi activity on the chain demonstrates that there is an organic source of demand for SOL. Furthermore, Canadian federal organization SOLWealth has announced plans to be the first to introduce a Solana Spot Exchange Traded Fund (ETF). The CEO, Francois Sato, suggests that the application be submitted to Canadian regulators after supplier partnerships are finalized. If the application is approved, regular investors can easily obtain exposure to the Solana ecosystem.

Institutional investment into Solana has also become apparent with the second round of auctions for the 41.1 M Solana tokens held by FTX. Investors’ bids for the tokens went through on the 25th of April and were finalized on the 30th of April. The purchased tokens are locked in a four-year vesting schedule, and successful bids range from $95 to $110, which is about a 15 to 25% discount from the current trading price. The discount is a notable decrease from 67% in the first round of the auction. Pantera Capital was among the winning bidders, with Bloomberg reporting that they received nearly 2000 SOL.

However, technical gripes keep many in the space skeptical about SOL. Despite a network update related to the QUIC protocol in April, the Solana network continued to face significant congestion. The rate of failed transactions is still above 62% at the time of writing. This disruption was attributed to an implementation bug in Solana’s network stack, exacerbated by MEV traders who submitted high transaction volumes. The issue arises from technical shortcomings in Solana’s static fee structure. It results in inefficiencies where the fees are not sufficient to deter spam or prioritize essential transactions effectively. Therefore, the attractively low fees that initially draw users to Solana may not be sustainable in the long run.

download

download download

download website

website